Based on the San Diego car accident law, you have the right to file for a claim after suffering from a car accident. However, dealing with car accident claims can become overwhelming when the negligent driver’s insurance company starts to delay the process. It is a common tactic that the insurance companies apply, and it involves stalling on your settlement.

The delays in the claim settlements are meant to minimize the payouts. Thus, you need to identify these intentional delays and take action accordingly. Here, we discuss the most common red flags that you need to be aware of:

- Excessive Requests for Documentation

The insurance company can ask for repetitive documentation, which is unnecessary and would delay the claim settlement timeframe. They can even ask for irreverent details, regardless of the fact that you have covered the standard documentation procedure. Excessive requests are a clear indication that they are stalling the claim.

- Prolong Communication Delays

If you find that the insurance adjusters are ignoring your inquiries or failing to respond to you on time, then it indicates that they are delaying the settlement on purpose. You might also find that your messages need to be answered or the responses are overly delayed, so these are red flags and are being done on purpose. You must consult a personal injury lawyer to help you with the hold-ups.

- Slow Investigation Process

A timely investigation of your car accident, including the causes and damages, is required so you get compensation as soon as possible. However, if the insurer is slow to inspect the damages or there is a delay in gathering evidence, it might indicate that they are intentionally stalling the process. A skilled attorney can help ensure investigations progress on time.

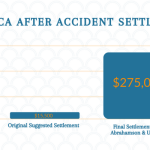

- Offering Low Settlements Early

You might also find that the insurer is proposing you accept an unreasonably low claim offer right after the accident. This is a tactic to discourage you from pursuing a fair settlement. The hasty process might also lead you to accept a low compensation without consulting the lawyer. Thus, the settlement will be complete before you realize that you are not being paid for the full extent of your damages.

- Dispute in Liability or Downplaying Injuries

To delay the settlement process or reduce the compensation, the insurance companies might even challenge the liability or raise questions about the severity of your injuries. This is another common tactic used by insurers, and only with the help of a personal injury lawyer can you come to a fair settlement by gathering strong evidence and encountering their questions.

- Waiting for Statute of Limitations Expiry

Often, the insurance companies delay the settlement process insurance companies in the hope that the statute of limitations will expire. Thus, you would have no right to pursue any legal action. Every delay is an indication of missed chances to get a fair settlement. In San Diego, the statute of limitations for car accident claims is two years, and only a lawyer can help you settle the case within the legal timeframe.

Conclusion

You might also get suggestions from the insurance adjusters that hiring a lawyer would complicate the process, which is a red flag. Thus, to get fair compensation, you must hire an attorney with experience dealing with car accidents to increase your chances of obtaining the successful claim you deserve.